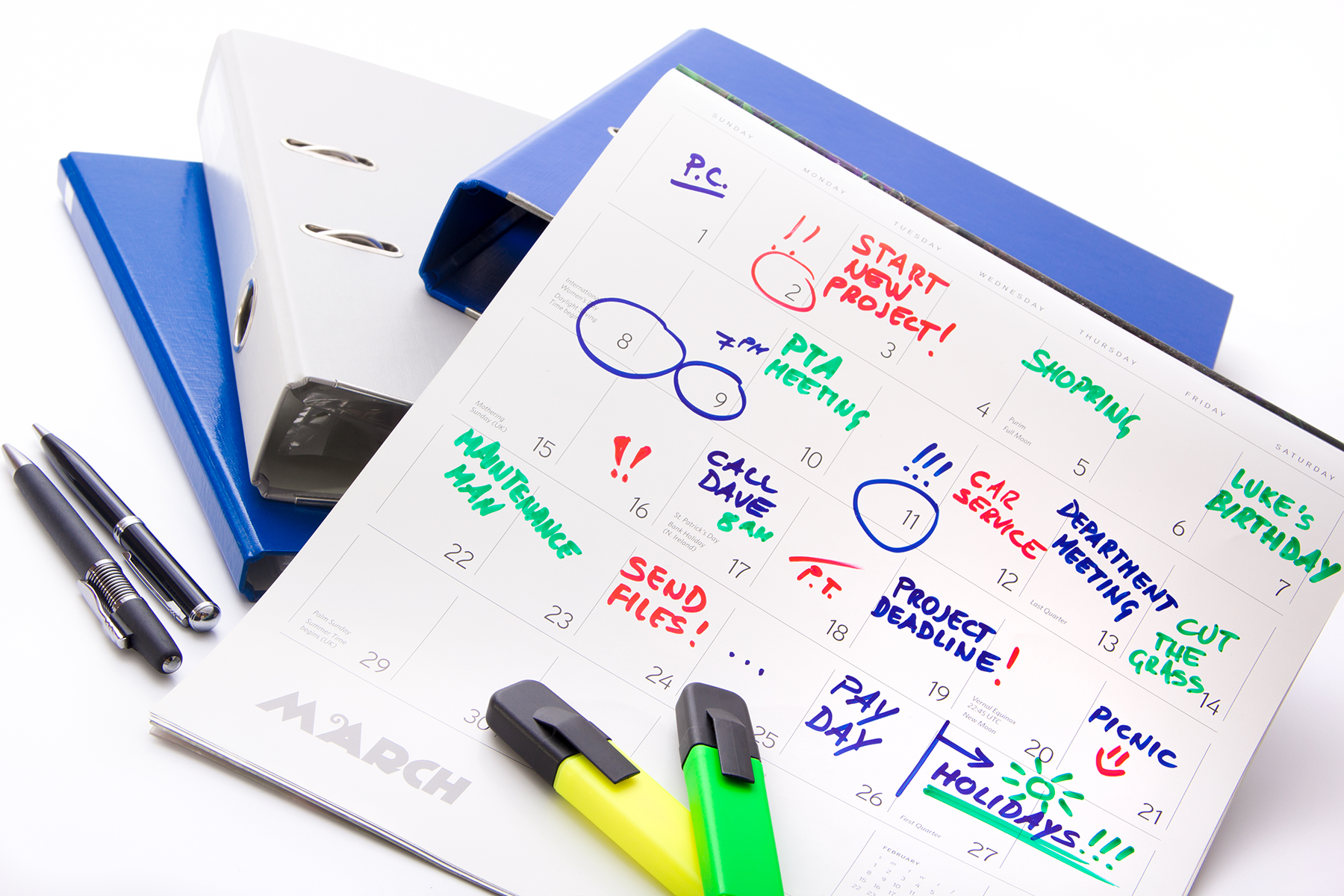

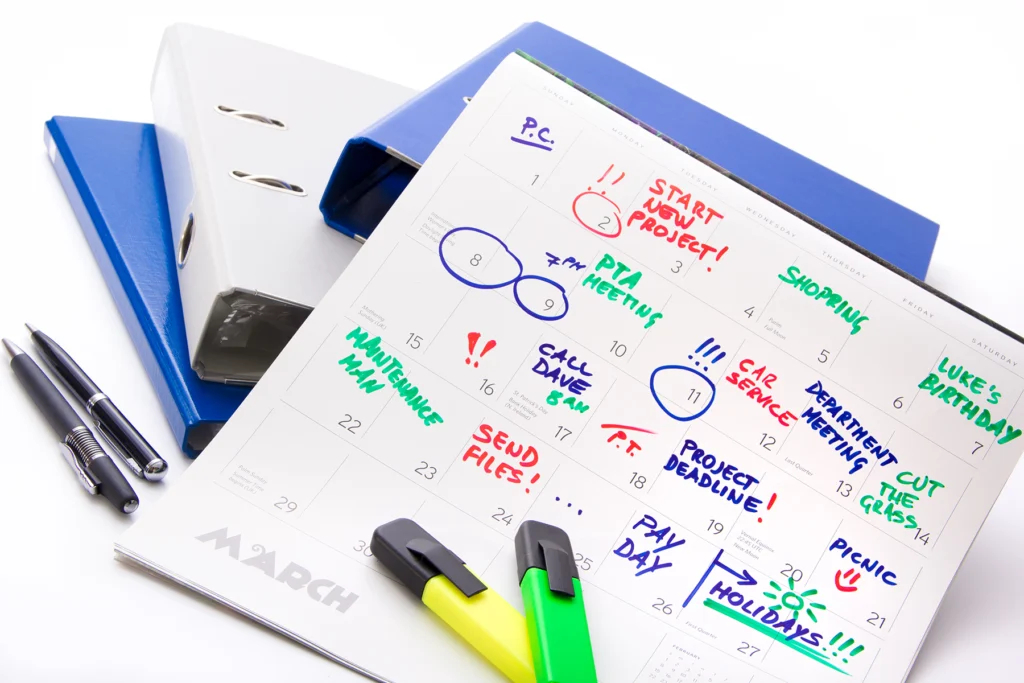

Our calendars are packed with dates — doctor visits, committee meetings, Friday night football. Miss one and you reschedule, vow to look at your calendar more often, etc. and life goes on.

Our calendars are packed with dates — doctor visits, committee meetings, Friday night football. Miss one and you reschedule, vow to look at your calendar more often, etc. and life goes on.

Food dates can get a wide range of reactions even within a single household. At my house, Mrs. Michael isn’t of fan of “the man” telling her what she can’t do, so she treats the dates on our food more like suggestions. For some, the date doesn’t matter. If something doesn’t smell bad, it’s fair game. It might not even have to smell like it used to. But, come on, what did milk really smell like in the first place? Me? I’m more cautious. I’m ready to toss something out the day after the “best buy” date. To me, that’s living on the edge because I’m giving it one more day than I should!

Insurance payment dates are nothing like the “best by” date on a carton of milk. With your home and auto policies, you’ve got two important dates:

- Due Date – The day your payment is actually due.

- Cancellation Date – The company’s final deadline before they shut you off.

Missing a due date can push your policy into a “pending cancellation” status, which becomes part of your payment history. While your coverage still works during this stage, repeated late payments can give your account a negative reputation. If you miss the final cancellation date, your coverage will end and depending on your account history, the company may not reinstate it. Once a policy cancels for nonpayment, shopping for new insurance can be more difficult than you might expect and will often result in a higher premium due to the lapse in coverage.

If your insurance payment is late once in a blue moon, it’s not the end of the world. But make a habit of it, and you’re asking for trouble. My advice: don’t play chicken with insurance dates. Aim for the due date every time. And if that’s tough, call your agent — there might be a payment plan that makes life a whole lot easier.